Ottawa-Swamp of Progressive Pundits Doesn’t Understand How ETFs work and A Primer on Carney’s Brookfield Tax Avoidance Scheme

can someone explain to progressives how financial things work?

Poilievre just told a Canadians that Carney is still invested in Brookfield, apparently Poilievre is also invested in Brookfield. Begs the question if he is also then benefiting from offshoring? — Althia Raj

Althia Raj is an Ottawa Swamp-based political pundit with the following media credentials — “It's Political” podcast host/producer, National columnist @TorontoStar, “At Issue” panellists on @CBCTheNational, Parfois aussi: @cpac_tv @iciradiocanada. One wonders how much Ms Raj had to stretch to perform this mental yoga.

Mark Gerresten, LPC MP for Kingston and Islands, didn’t miss his chance to jump on the useful idiot train, posting a graphic with breaking news in big bold block cap letters, and making the following statement, (emphasis is Gerresten’s and not mine).

The most recent filing with the Ethics Commission reveals that Pierre Poilievre's investments include Vanguard FTSE Canada Index ETF. One of the top assets in that fund is... Brookfield, the investment firm where Mark Carney was formerly chair of the board. Pierre Poilievre may desperately attack Brookfield, but Poilievre invests in Brookfield. WHATEVER PIERRE POILIEVRE SAYS PUBLICLY, EVEN POILIEVRE BELIEVES BROOKFIELD IS A GOOD INVESTMENT. — Team Gerresten

What are the facts, reader?

Facts do matter, as our non factual progressive friends remind us when they promote their progressive fiction as factual. Fact is that Vanguard is an exchange-traded fund, similar to a mutual fund. When a person invests in an ETF or mutual fund he or she invests in a basket of assets, and has no say in the individual companies that belong to that fund. So, nah, Poilievre didn’t choose Brookfield as a stock to invest in, nah he didn’t trust Carney, former head of Brookfield Asset Management, to invest his money. He possibly didn’t know all the assets in the ETF, that’s why people choose ETFs and mutual funds, because they trust the fund managers to do the research and be tapped in to the market to make the decisions that otherwise they would be required to do on their own investing in individual stocks. So, there’s nothing here except that Poilievre disclosed his financials. Has Carney done so? No, he apparently refuses to disclose what’s in the blind trust, according to multiple news reports.

An exchange-traded fund is an investment vehicle that pools a group of securities into a fund. As its name indicates, it can be traded like an individual stock on an exchange. — Investopedia

When you buy shares of an ETF, you own a fraction of the underlying pool of investments, similar to buying shares of a mutual fund. The net asset value (NAV) of an ETF represents the per-share value of the fund’s assets less any liabilities. — State Street Global advisors

Let’s compare — a career politician who has lived in Canada all his life versus a career banker and finance guy, who holds three passports, was educated at Harvard and Oxford, has spent the greater part of the past 2 decades living outside Canada.

Let’s take a quick look at Mark Carney.

plastering the assets with more debt, ramping up the related party deals, paying nary a skerrick in income tax, asset stripping, playing the government for grants, hiding stuff, letting service levels slide and ripping out billions to tax havens. — Michael West (via CICTAR)

Carney advised Trudeau during the pandemic and in September 2024 he became chair of the Liberal Party’s economic growth task force. In March of 2024 Carney, as a member of a select group of Western executives, travelled to China to meet China’s President Xi Jingping. Carney returned to China in October, just a month after joining Liberal Prime Minister Justin Trudeau’s economic task force. During this visit, he held meetings with senior Chinese officials, including a private session with Beijing Mayor Yin Yong … The following month, as reported by Bloomberg on November 5, 2024, Brookfield secured a $276 million loan from the Bank of China—underscoring Carney and the firm’s deep financial connections to the People’s Republic (Sam Cooper, The Bureau).

So, let’s recap.

Perhaps the most disturbing part of the report is a redacted case study in which an unknown Member of Parliament is said to have “maintained a relationship with a foreign intelligence officer” and to have “proactively provided the intelligence officer with information provided in confidence.”

As Canadian national security expert Wesley Wark wrote: “There is no other word for it. This is treason.”

Opposition MPs have demanded that the redacted names of Parliamentarians who “wittingly assisted foreign state actors” be named, but the Government has staunchly refused to release any further information, citing national security concerns and the desire not to undermine due process of any ongoing criminal investigations. — Daniel Dorman, McDonald Laurier Institute

Carney has close political and financial ties to China, a hostile foreign power that’s infiltrated Canada’s political infrastructure at local, provincial and federal levels, that’s engaged in election interference, that holds Uyghurs in “vocational education and training centres”, (the PRC official name for Xinjiang’s Uyghur internment camps), that has invasive data collection regulations. But wait, there’s more! The Centre for International Corporate Tax Accountability and Research (CICTAR), reported that, under Carney’s guidance, Brookfield operated an aggressive tax avoidance strategy.

In fact, in 2017 The Toronto Star reported Brookfield as the amongst the worst offenders of all Canadian corporations, it had an amongst the lowest effective tax rates, at half the rate of the five big banks.

Through complex corporate structures, with an exceptional reliance on Bermuda, Brookfield manages over $800 billion in global assets. Related party debt payments and other artificial transactions may substantially reduce taxable income where profits are earned. Brookfield’s aggressive tax avoidance schemes appear to deprive governments and communities of much-needed revenue for essential public services, including health and education. — CICTAR Report

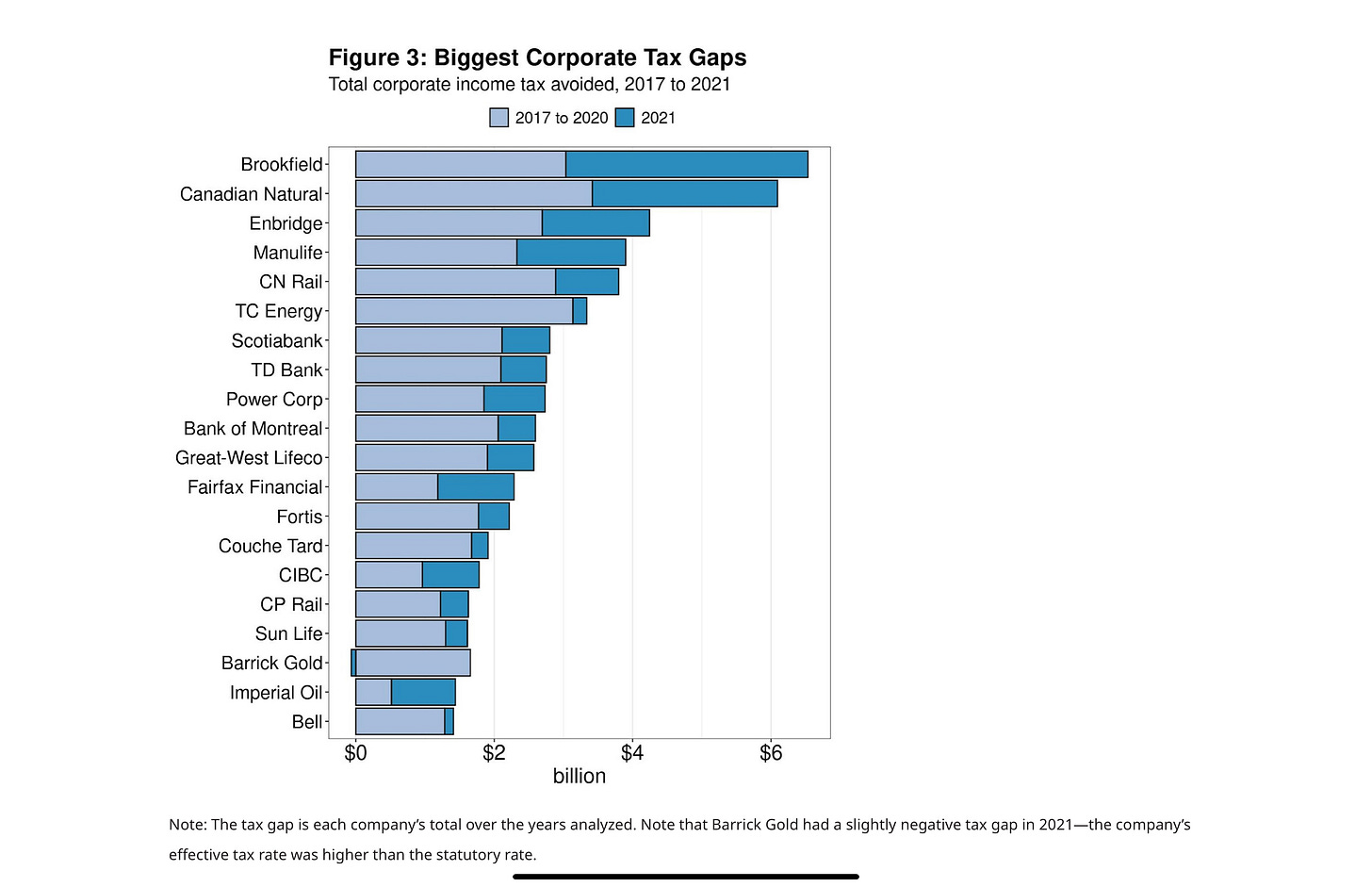

The largest tax gap for 2017 to 2021 belonged to Brookfield Asset Management. Close behind was the oil and gas company Canadian Natural Resources. However, large tax gaps are not limited to just one or two industries. Figure 3 shows the 20 biggest total tax gaps over the last five years. It includes companies from a range of industries. Four of the Big 5 Banks are there (RBC had the 26th largest tax gap). In addition to Canadian Natural Resources, Imperial Oil and Barrick Gold represent extractive companies. Canada’s pipeline giants, Enbridge and TC Energy, are third and sixth, respectively. While Bell was the only telecom to make the Top 20, Rogers is 29th and Telus is 31st. — Canadians for Tax Fairness (CATF)

Reader, did you catch that? Our Mister Climate Zealot GFANZ Climate Cartel King, who’s spent years trying to kill Canada’s oil and gas industry because of his obsessive hatred for fossil fuels, operated a global corporation that has a bigger tax gap than the oil and gas industry he villainises.

At this point readers are asking: so, what’s your point, Bad Hijabi?

Well, reader, my point is that Pierre Poilievre’s Vanguard EFT investment is a nothing-burger and you should think for yourself and remember that Canada’s legacy media is a hostile player in this election campaign and you should treat them as such. Question everything and seek valid and reliable sources of news information. That definitely precludes the CBC and other mainstream media with a known progressive-radical left wing bias.

For the slow ones in the audience, tax avoidance harms the public because it deprives the public purse money for operating governmental and social programming and services. Taxes pay the government, which is the country, it’s you and I, to manage the infrastructure we all rely on for our health care system, safety and security, and justice system, amongst other important things we all take for granted.

The man who made a business out of ripping off Canadians from corporate tax payments now wants to run Canada, and he’s tell you and I that he wants to create resilience and strength that puts the prosperity of Canadians at the forefront of every decision. He’s not given Canada’s prosperity much thought though, has he, in his tax avoidance business scheming? Why would you think he would do now?

Q: Is Poilievre also then benefiting from offshoring?

A: NO, he is not because Poilievre is not the guy who headed an asset management company that ran an aggressive tax avoidance scheme and holds the consistent record as the worst corporate tax evader. And he isn’t the guy who has a close political relationship with Xi Jinping and he’s not the guy who secured a loan from Bank of China for his asset management company.